The Four Steps to Comprehensive Compliance Screening: Customer Verification, All-in-One Risk Management, Data Confidentiality, and Due Diligence.

Ensuring the legitimacy of individual identities, corporate accounts, and ownership verification processes accurately.

Screening for Sanctions. Evaluating Money Laundering Risks. Investigating High-Risk Customers.

Consistent customer screening ensures up-to-date risk profiles and diligent due diligence practices.

Utilizing advanced cloud technology for securely storing and managing essential records efficiently.

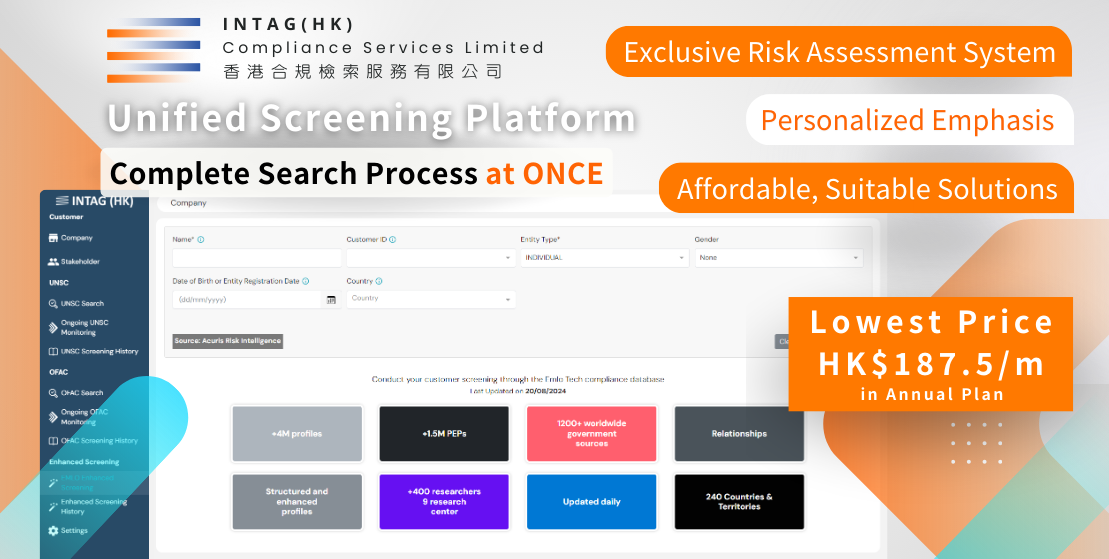

Safeguarding Business Compliance: Seamless Solutions for Enhanced Management.

A Straightforward risk assessment questionnaire aids and organizing data for personalized client management.

Access over 5 million high-risk records and 200 million company credit reports to streamline compliance maintenance effortlessly.

Instant OFAC & UNSC lists, saved search history, and continuous monitoring for vital updates.

Choose: Single or Yearly Access with INTAG